profhimservice76.ru

Prices

How Do Money Market Mutual Funds Work

Government money market funds are defined as money market funds that invest % or more of their total assets in very liquid investments, namely, cash. A money market fund (MMF) is a type of mutual fund that invests in cash, cash equivalents and short-term debt securities. A money market fund (MMF) is a type of mutual fund that invests in cash, cash equivalents and short-term debt securities. Money market funds are a type of mutual fund that invests in low-risk, short-term debt securities, such as Treasury bills, municipal debt, or corporate bonds. A money market mutual fund is a cash alternative that offers returns that might exceed bank account interest rates. Learn how these investments work. How do money market funds work? Money market funds pool money from multiple investors and invest in a diversified portfolio of money market instruments. These. Money market funds invest in high quality, short-term debt securities and pay dividends that generally reflect short-term interest rates. Many investors use. Money market funds are a type of mutual fund developed in the s as an option for investors to purchase a pool of securities that generally provided higher. A money market fund is a type of mutual fund that invests in high-quality, short-term debt instruments and cash equivalents. Tracking error tells the. Government money market funds are defined as money market funds that invest % or more of their total assets in very liquid investments, namely, cash. A money market fund (MMF) is a type of mutual fund that invests in cash, cash equivalents and short-term debt securities. A money market fund (MMF) is a type of mutual fund that invests in cash, cash equivalents and short-term debt securities. Money market funds are a type of mutual fund that invests in low-risk, short-term debt securities, such as Treasury bills, municipal debt, or corporate bonds. A money market mutual fund is a cash alternative that offers returns that might exceed bank account interest rates. Learn how these investments work. How do money market funds work? Money market funds pool money from multiple investors and invest in a diversified portfolio of money market instruments. These. Money market funds invest in high quality, short-term debt securities and pay dividends that generally reflect short-term interest rates. Many investors use. Money market funds are a type of mutual fund developed in the s as an option for investors to purchase a pool of securities that generally provided higher. A money market fund is a type of mutual fund that invests in high-quality, short-term debt instruments and cash equivalents. Tracking error tells the.

The BMO Money Market Fund's main objective is to achieve a high level of after-tax return, including dividend income and capital gains. Money market mutual fund income is usually in the form of a dividend; it can be taxed or tax-exempt depending on the nature of securities invested in the fund. A money market fund is a type of fixed income mutual fund that invests in debt securities characterized by their short maturities and minimal credit risk. A money market mutual fund is a cash alternative that offers returns that might exceed bank account interest rates. Learn how these investments work. A money market fund is a type of fixed income mutual fund that invests in debt securities characterized by their short maturities and minimal credit risk. A Money Market fund is a mutual fund that invests in short-term, higher quality securities. Designed to provide high liquidity with lower risk. A money market mutual fund, or money market fund, is an investment that holds cash and cash-equivalent securities within the fund. It's a low-risk investment. Money market funds are fixed-income mutual funds that invest in debt securities characterized by short maturities and minimal credit risk. How Do Money Market Mutual Funds Work? Just like individuals, the government, corporations, and banks often need to borrow money for a short time to make. Steady Returns: Money market funds generate steady returns through cycles of interest rate tightening and easing, because fund values do not change much in. A money market mutual fund is a cash alternative that offers returns that might exceed bank account interest rates. Learn how these investments work. Money market mutual funds typically purchase highly liquid investments with varying maturities, so there is cash flow to meet investor demand to redeem shares. How does a money market fund work? Money market funds generate a return that is primarily driven by the interest rates on the underlying investments in their. In the simplest terms, a mutual fund is managed product that pools money from different investors for the purpose of trading securities and earning a profit. This type of fund is relatively low risk and usually pays out your return in dividends, with other alternative payments also available. A money market fund is. A money market fund is a type of fixed income mutual fund that invests only in highly liquid, short-term debt. Money Market Funds. A money market fund is a kind of mutual fund that invests in highly liquid, near-term instruments. These instruments include cash and. A money market fund is a type of mutual fund that invests in high-quality, short-term debt instruments and cash equivalents. Money market funds operate much like other mutual funds. When you buy units, the fund invests your money to purchase short-term corporate, bank or government. Money market mutual funds typically purchase highly liquid investments with varying maturities, so there is cash flow to meet investor demand to redeem shares.

Stock Option Distribution

You should receive your proceeds within. 8 – 10 business days from the trade date. Check via overnight delivery: Morgan Stanley can send your proceeds via. A qualified stock option is not taxable under the Internal Revenue Code at the time of its grant or at the time, the employee exercises the option (IRC Section. Options granted under an employee stock purchase plan or an incentive stock option (ISO) plan are statutory stock options. Stock options that are granted. Of course, the shares of stock for the pool and for stock option stock options for preferred shares (or stock that has distribution preferences). When an employee exercises a stock option, he receives a capital gain. If distribution award, or division of assets determination. In this instance. In no event may you exercise your option unless the shares of Common Stock issuable upon exercise are then registered under the Securities Act or, if not. Market Value of a share of Common Stock on the date such Option is granted. The Option or portion of the Option may be exercised by delivery of an irrevocable. Each standard equity option covers shares of Exercise or assignment of equity options results in acquisition or delivery of the underlying shares. Upon the sale of the underlying shares from an exercise of your stock options, the proceeds will be distributed, as per your instructions, three business. You should receive your proceeds within. 8 – 10 business days from the trade date. Check via overnight delivery: Morgan Stanley can send your proceeds via. A qualified stock option is not taxable under the Internal Revenue Code at the time of its grant or at the time, the employee exercises the option (IRC Section. Options granted under an employee stock purchase plan or an incentive stock option (ISO) plan are statutory stock options. Stock options that are granted. Of course, the shares of stock for the pool and for stock option stock options for preferred shares (or stock that has distribution preferences). When an employee exercises a stock option, he receives a capital gain. If distribution award, or division of assets determination. In this instance. In no event may you exercise your option unless the shares of Common Stock issuable upon exercise are then registered under the Securities Act or, if not. Market Value of a share of Common Stock on the date such Option is granted. The Option or portion of the Option may be exercised by delivery of an irrevocable. Each standard equity option covers shares of Exercise or assignment of equity options results in acquisition or delivery of the underlying shares. Upon the sale of the underlying shares from an exercise of your stock options, the proceeds will be distributed, as per your instructions, three business.

An employee stock ownership plan (ESOP) is a retirement plan in which an employer contributes its stock to the plan for the benefit of the company's. Benefit Access allows you to track and exercise your stock options, and select between proceeds distribution exercising a Non-qualified Stock Option? A. These equity vehicles are quite different from a stock option, which is the right to purchase company stock at a given price, in that RS and RSUs have an. The hope is that by the time the employee's options vest—that is, at the time the employee can actually exercise the options to buy stock at the set price—that. The answer is that options provide far greater leverage. For a company with an average dividend yield and a stock price that exhibits average volatility, a. (b) A "distributor" of Nasdaq options market data is any entity that receives a feed or data file of Nasdaq data directly from Nasdaq or indirectly through. The adjustment would apply to all options that were outstanding when the Special Distribution was paid. The options would cover the same stock before and after. There are two types of stock options that companies may offer as part of their stock plans: Incentive Stock Options and Nonqualified. The recipient of a stock. Astrella's stock option management software helps you manage up-to-the-minute information about equity grants, vesting schedules, & settlements. Learn more. Notice offers relief for certain ESOP amendments that eliminate a distribution option to meet new diversification requirements. Determination Letter. The adjustment would apply to all options that were outstanding when the Special Distribution was paid. The options would cover the same stock before and after. An incentive stock option may contain a number of permissible provisions that do not affect the status of the option as an incentive stock option. See § With the Administrator's consent, these arrangements may include withholding Shares that otherwise would be issued to the Optionee pursuant to the exercise of. An employee stock option pool is a block of shares specifically allocated for a company's employees. · An option pool creates dilution for both founders and. An option contract may be adjusted due to a certain type of dividend, stock distribution, stock split, or similar event with respect to an underlying security. in the form of stock options. – How much equity should we set aside for employees? • A plan for how these options will be distributed: – How many shares will. For example, a stock holder of ABC shares trading at $ per share will receive a cash dividend on the payment date of $ — if they owned ABC. If a company were to grant stock, rather than options, to employees, everyone would agree that the company's cost for this transaction would be the cash it. No participant may be granted Stock Options and Stock Appreciation Rights covering in excess of 1 million shares of Common Stock in any fiscal year of the.

Best Place To Advertise Jobs For Free

Reach qualified candidates where they're already spending their time. Create free job postings on your Page to advertise open role opportunities. Faculty and administrative positions at colleges and universities. Now listing jobs. Updated daily. Free to job seekers. Indeed is currently the world's largest job board with over million job seekers. It allows small business owners to post jobs for free and to use tools like. Employers · Post Jobs. Attract employees by posting detailed information about open positions. · Find Talent. Use the resume search to connect with qualified. It may depend on the kind of position you're advertising for, but I've found good success on Indeed, LinkedIn, and ZipRecruiter. There are. CTHires - Complete set of employment tools for job seekers in Connecticut. Search jobs, create résumés, find education and training. Follow the instructions below to submit a job posting by fax, email, or phone: By Fax: Outside New York City: For jobs located in New York State (not in New. Advertise jobs for free on various job boards and social media in one click. Have all your jobs automatically posted on your website by integrating it with. free job posting jobs available in new york, ny. See salaries, compare reviews, easily apply, and get hired. New free job posting careers in new york. Reach qualified candidates where they're already spending their time. Create free job postings on your Page to advertise open role opportunities. Faculty and administrative positions at colleges and universities. Now listing jobs. Updated daily. Free to job seekers. Indeed is currently the world's largest job board with over million job seekers. It allows small business owners to post jobs for free and to use tools like. Employers · Post Jobs. Attract employees by posting detailed information about open positions. · Find Talent. Use the resume search to connect with qualified. It may depend on the kind of position you're advertising for, but I've found good success on Indeed, LinkedIn, and ZipRecruiter. There are. CTHires - Complete set of employment tools for job seekers in Connecticut. Search jobs, create résumés, find education and training. Follow the instructions below to submit a job posting by fax, email, or phone: By Fax: Outside New York City: For jobs located in New York State (not in New. Advertise jobs for free on various job boards and social media in one click. Have all your jobs automatically posted on your website by integrating it with. free job posting jobs available in new york, ny. See salaries, compare reviews, easily apply, and get hired. New free job posting careers in new york.

Start by creating an account and registering your business or employer on Job Bank. Then, post your jobs and we'll make sure they reach the best-fitting. 1. Your Website · 2. Your Intranet/Notice Board/Shop Window/Newsletter · 3. Social Media · 4. Free Websites · 5. Universal Job Match / Job Centre. You're ready to get the word out about your openings. Breezy will advertise your open positions on 50+ top job sites, with a single click. Learn more about. The GCSAA Job Board is intended for advertisements of golf course maintenance department positions only. All individual users wanting to post a job or resume. Welcome to the Ontario Job Bank! Employers can use the Job Bank to find the right workers for their business, advertise jobs for free to thousands of people and. NCWorks Online - Complete set of employment tools for job seekers in North Carolina. Search jobs, create résumés, find education and training. ZipRecruiter — Your All-in-One Job Search Companion: Navigating the NYC job market can be overwhelming, but ZipRecruiter is a reliable ally in. Using New York's Job Bank you can search open job opportunities, post your resume so employers can find you and sign up to receive e-mails about new job. Discover state- or federally funded training programs to enter a new career. Create an account; it's free. Learn More. Employers. Post Jobs. Attract employees. Flexijobz is the best and free job post sites for blue collar profhimservice76.ru are hundreds of thousands of great jobs out there and we have them. Post jobs for free on Recooty. Job posting sites include Indeed, LinkedIn, Google, Glassdoor, and more. Try for free today. Your company LinkedIn page is the perfect place to post jobs, as everyone following your page is already interested in your brand. Write a short status. MarketingHire was selected as one of MarketingSherpa's "best job sites for marketing, advertising and PR pros."[MarketingHire] is part of the Marketing Career. Employ Florida. Employ Florida Plus Logo. Enter a keyword and/or location to find jobs. Post job listings, search for qualified employees, analyze labor. Social media sites like Facebook, Twitter, and LinkedIn can also be used for posting free jobs online, and sharing services like Twitter can be used to. Finding, hiring and retaining great workers is a key strategy in building a successful profhimservice76.ruers can now post jobs on the National Job Bank. Missouri's Workforce System is comprised of the Office of Workforce Development, state and local workforce boards, and numerous partner agencies that promote. Google for Jobs can be an insanely valuable source of organic candidate applications - the way they're set up, candidates can view your advert. CalJOBS - Complete set of employment tools for job seekers in California. Job seekers and employers access jobs, résumés, education, training, labor market.

Does Find My Friends Work When Phone Is Off

The Hide My Location feature is active on your friend's phone. Your friend's location is in a country or region where Apple doesn't provide this feature. There. When your lost device is offline but close to another device, it's able to connect to that other device over Bluetooth and relay its location. That means that. Find my friends work brilliantly on the iPhone and Android both. All you need is install it in just a few clicks, and share your location with friends and. However, you can try using the Find My feature or Family Orbit (if it is already activated) to see the last location of the device. Conclusion. By being. According to Apple, the Find My app will display your iPhone's last known location for up to 7 days after your phone goes offline or dies. The iCloud website. Find My Friends allows you to easily locate friends and family using your iPhone, iPad or iPod touch. Just install the app and share your location with your. If you sign out of iCloud on your device, it will also sign you out of the Find My app, and you will no longer be able to see the location of your iPhone on. Since Life utilizes GPS data to calculate a person's location, the app won't work properly without access to the information. Your last known location will. Does Find My iPhone work when a phone is dead? Yes. If your lost iPhone is dead, you can see the last known location but not the current location. As long as. The Hide My Location feature is active on your friend's phone. Your friend's location is in a country or region where Apple doesn't provide this feature. There. When your lost device is offline but close to another device, it's able to connect to that other device over Bluetooth and relay its location. That means that. Find my friends work brilliantly on the iPhone and Android both. All you need is install it in just a few clicks, and share your location with friends and. However, you can try using the Find My feature or Family Orbit (if it is already activated) to see the last location of the device. Conclusion. By being. According to Apple, the Find My app will display your iPhone's last known location for up to 7 days after your phone goes offline or dies. The iCloud website. Find My Friends allows you to easily locate friends and family using your iPhone, iPad or iPod touch. Just install the app and share your location with your. If you sign out of iCloud on your device, it will also sign you out of the Find My app, and you will no longer be able to see the location of your iPhone on. Since Life utilizes GPS data to calculate a person's location, the app won't work properly without access to the information. Your last known location will. Does Find My iPhone work when a phone is dead? Yes. If your lost iPhone is dead, you can see the last known location but not the current location. As long as.

4.Does Find My Friends work when iPhone is off? If your iPhone is turned off, Find My will show the last location updated from your device, which means, you. Find My Friends is a locations saving and live location sharing & tracking app with your family & friends. Use Find Friends app to share your real-time. No, if your iPhone is switched off, the Find My Friends app or the Find My app (depending on the iOS version) will not be able to track or. Yes. If you have Find My Network on, the phone is findable even if off. It uses very low power communications so that other devices in Apple's Find My network. The Hide My Location feature is active on your friend's phone. Your friend's location is in a country or region where Apple doesn't provide this feature. There. Find my friends work brilliantly on the iPhone and Android both. All you need is install it in just a few clicks, and share your location with friends and. *Find My Device network requires location services and Bluetooth to be turned on. Requires cell service or internet connection. Works on Android 9+ and in. When the "Location Not Available" message appears on Find My Friends, it means that you have disabled location sharing or have turned off your device's. Location Sharing works even when Location History is turned off. You may get Tip: If you have a Pixel phone, learn how to find someone with Live View. Internet Connection Issues: Unstable or disconnected network connections can cause Find My Friends to not update the location on your device. Location Services. 3. Disabled Location Services: Because your family's or friend's phone's location services have been disabled, the Find My Friends app will not be able to get. Keep in mind that for the time period you select, the friend will be able to see exactly where you are unless you turn your location off, or you don't have. What happens when Wifi is turned off is that it is only relying on one piece of information instead of two to locate the device. When you're inside a building. Find my friends work brilliantly on the iPhone and Android both. All you need is install it in just a few clicks, and share your location with friends and. If you sign out of iCloud on your device, it will also sign you out of the Find My app, and you will no longer be able to see the location of your iPhone on. To turn off the Find My app, your iPhone must be connected to a Cellular Data or Wi-Fi network. Without a connection, the app is turned off on the device. When your lost device is offline but close to another device, it's able to connect to that other device over Bluetooth and relay its location. That means that. Yes, it is possible to track a phone that is turned off, but with some limitations. When a phone is powered off, the network and GPS radios are deactivated. To see your device even when it's offline, turn on Find My network by tapping the switch. For more steps to take if your device is misplaced, read our guide to. However, if your iPhone is running a version older than iOS 15, Find My can also show the "Offline" status when the device is powered off. If you suspect that.

Inflation Increases Interest Rates

Cost-push inflation occurs when prices increase because production is more expensive — whether it's because of higher wages or material prices. Companies pass. TransUnion's (NYSE: TRU) newly released Q2 Consumer Pulse study found that consumer concerns about inflation and interest rates reached their highest. Inflation is the rate of increase in prices over a given period of time. Inflation is typically a broad measure, such as the overall increase in prices. How does increasing interest rates reduce inflation? Increasing the bank rate is like a lever for slowing down inflation. By raising it, people should, in. Inflation and interest rates tend to move in the same direction, because interest rates are the primary tool used by the US central bank to manage inflation. Inflation also affects interest rates. If you've heard a news commentator talk about the Federal Reserve Board raising or lowering interest rates, you may not. Inflation can also affect interest rates. The higher the inflation rate, the more interest rates are likely to rise. This occurs because lenders will demand. The short answer is that when inflation is high, the Federal Reserve often raises interest rates to encourage less spending and to keep prices steady. The primary tool the Bank uses to control inflation is the policy interest rate. A higher rate helps decrease inflation and a lower one helps it rise. Cost-push inflation occurs when prices increase because production is more expensive — whether it's because of higher wages or material prices. Companies pass. TransUnion's (NYSE: TRU) newly released Q2 Consumer Pulse study found that consumer concerns about inflation and interest rates reached their highest. Inflation is the rate of increase in prices over a given period of time. Inflation is typically a broad measure, such as the overall increase in prices. How does increasing interest rates reduce inflation? Increasing the bank rate is like a lever for slowing down inflation. By raising it, people should, in. Inflation and interest rates tend to move in the same direction, because interest rates are the primary tool used by the US central bank to manage inflation. Inflation also affects interest rates. If you've heard a news commentator talk about the Federal Reserve Board raising or lowering interest rates, you may not. Inflation can also affect interest rates. The higher the inflation rate, the more interest rates are likely to rise. This occurs because lenders will demand. The short answer is that when inflation is high, the Federal Reserve often raises interest rates to encourage less spending and to keep prices steady. The primary tool the Bank uses to control inflation is the policy interest rate. A higher rate helps decrease inflation and a lower one helps it rise.

The interest rate on a Series I savings bond changes every 6 months, based on inflation. The rate can go up. The rate can go down. But if the inflation rate were to unexpectedly rise to 7 percent, the real interest rate would become negative 1 percent. In this instance, the borrower would. Link between rise of inflation rate and rise of interest rates: One of the main goals of central banks' monetary policy is to maintain price stability and. After the pandemic, inflation skyrocketed as prices on everything from rent to food increased. In response, the Federal Reserve started increasing interest. Increasing interest rates can help tamp down on inflation — and how doing so could result in a recession. Central banks often adjust interest rates according to inflation. Raising and lowering interest rates may help manage inflationary pressures on the economy. Higher interest rates encourage saving and discourage borrowing and, in turn, spending. In response, companies increase their prices more slowly or even lower. Very simply, increasing interest rates reduces the money supply growth as fewer loans are made (because they cost more) which means that. The US Federal Reserve has implemented four consecutive % rate hikes in recent months bringing the base interest rates in the US to between % and 4%. Taylor) recommends that interest rates rise one-and-a-half times as much as inflation. So if inflation rises from 2 percent to 5 percent, interest rates should. My research suggests that in the short run, raising interest rates could actually make inflation worse, as business cost increases from rate hikes get passed. The Fed has repeatedly raised rates in an effort to corral rampant inflation that has reached year highs. Higher interest rates may help curb soaring prices. When the inflation rate is high, interest rates tend to rise too – so although it costs you more to borrow and spend, you could also earn more on the money you. The Federal Reserve maintained the federal funds rate at a year high of %% for the 8th consecutive meeting in July , in line with expectations. What is the impact of inflation and rising interest rates on my current and future loans and savings? When interest rates rise, the cost of the money you borrow. We all know that when inflation falls, so do interest rates, and then when inflation trends upward, interest rates rise to fight back. Although inflation is likely to ease steadily in , interest rates will stay at peak levels for some time, with important implications for GDP growth, bond. Yields on actively traded non-inflation-indexed issues adjusted to constant maturities. The year Treasury constant maturity series was discontinued on. To stabilise inflation, central banks tend to adjust interest rates from time to time to ensure the economy will not get overheated or shrink. If interest rate. If you already own your home, an increase in inflation might also make it more costly to refinance your mortgage. For those with fixed-rate mortgages, rising.

Nadex.Com

Nadex is for short-term traders who want to engage in binary options, knock-outs, and call spreads trading using a U.S.-based, fully regulated exchange. Nadex (Northern American Derivatives Exchange), formerly known as HedgeStreet, is a US-based retail-focused online binary options exchange. Nadex offers a different type of trading. A new kind of opportunity. Trade unique short-term contracts around the clock including forex, stock index futures. NADEX customer support is available during opening hours: from Sunday 3 pm ET through Friday pm ET. Besides that, customer support is not available on. How many stars would you give Nadex? Join the people who've already contributed. Your experience matters. Nadex is part of North American Derivatives Exchange, Inc.. They spent under $ million on advertising in the last year. They are currently not investing. Nadex is a leading US-regulated exchange offering limited-risk binary options & spread trading across global markets like forex, indices, oil, gold & more. See what employees say it's like to work at Nadex. Salaries, reviews, and more - all posted by employees working at Nadex. Nadex is the leading US-regulated exchange in North America offering binary option and spread trading on a wide variety of global markets. Nadex is based in. Nadex is for short-term traders who want to engage in binary options, knock-outs, and call spreads trading using a U.S.-based, fully regulated exchange. Nadex (Northern American Derivatives Exchange), formerly known as HedgeStreet, is a US-based retail-focused online binary options exchange. Nadex offers a different type of trading. A new kind of opportunity. Trade unique short-term contracts around the clock including forex, stock index futures. NADEX customer support is available during opening hours: from Sunday 3 pm ET through Friday pm ET. Besides that, customer support is not available on. How many stars would you give Nadex? Join the people who've already contributed. Your experience matters. Nadex is part of North American Derivatives Exchange, Inc.. They spent under $ million on advertising in the last year. They are currently not investing. Nadex is a leading US-regulated exchange offering limited-risk binary options & spread trading across global markets like forex, indices, oil, gold & more. See what employees say it's like to work at Nadex. Salaries, reviews, and more - all posted by employees working at Nadex. Nadex is the leading US-regulated exchange in North America offering binary option and spread trading on a wide variety of global markets. Nadex is based in.

Company profile page for Nadex Inc including stock price, company news, executives, board members, and contact information. NADEX, Chicago, Illinois. 12 likar · 5 snakkar om dette · var her. A different kind of trading. Short-term contracts around the clock on forex. Nadex is the leading US-based CFTC-regulated financial exchange for binary options and option spreads. We're located in the heart of Chicago's financial. Nadex offers a different type of trading. A new kind of opportunity. Trade unique short-term contracts around the clock including forex, stock index futures. How many stars would you give Nadex? Join the people who've already contributed. Your experience matters. Nadex is a leading US-regulated exchange offering limited-risk binary options & spread trading across global markets like forex, indices, oil, gold & more. I suggest that you use JavaScript from profhimservice76.ru It's always up-to-date and works just like the official web site, obviously. Nadex is the leading US-regulated exchange in North America offering binary option and spread trading on a wide variety of global markets. The Dexie Indicator is a Forex indicator system built for the 5 min chart. It is suitable for Forex traders and Nadex users and provides BUY/SELL signals with. Find out what works well at Nadex from the people who know best. Get the inside scoop on jobs, salaries, top office locations, and CEO insights. NADEX manufactures a complete line of cash and coin handling products for businesses of all sizes: from retail stores, restaurants, casinos, charities and more. RE: Rule Certification of New Products: Five Nadex Political Event Derivatives®. (Democratic Majority in the United States House Of Representatives Binary. The company is established by Nadex Co., Ltd. as a % subsidiary. The company is engaged in design, manufacturing, sale and after-sale services of automobile. North American Derivatives Exchange (Nadex) has launched eight new knock-outs and ten new call spreads which are now available to trade with a live Nadex. Information on acquisition, funding, cap tables, investors, and executives for Nadex (Other Capital Markets/Institutions). Use the PitchBook Platform to. Details · Contact Email [email protected] · Phone Number Yes, you can make money with Nadex. Sadly, most fail but this isn't due to Nadex as a company but more because of lack of skill and discipline. The Dexie Indicator is a Forex indicator system built for the 5 min chart. It is suitable for Forex traders and Nadex users and provides BUY/SELL signals with. profhimservice76.ru is ranked # in the Investing category and # globally in July Get the full profhimservice76.ru Analytics and market share drilldown here. Nadex United States employs 95 employees. Reveal contacts of top Nadex managers and employees.

Best Ways To Raise Your Credit

How do you improve your credit score? · Review your credit reports. · Pay on time. · Keep your credit utilization rate low. · Limit applying for new accounts. · Keep. You can optimize this by adjusting both variables; you can spend less, and you can open new credit accounts or ask for increases on your existing credit limits. How to Build Good Credit · Review your credit reports. · Get a handle on bill payments. · Use 30% or less of your available credit. · Limit requests for new credit. Building a good credit score · Create a plan · Contact all creditors. · Pay off delinquent accounts first, then debts with higher interest rates; you may save. One of the easiest ways to improve your credit score is by paying your bills on time every month. This will start to eliminate your credit card debt. Your. If your creditworthiness has taken a ding, these fixes should spruce it up · 1. Check your credit report at least once a year · 2. Set up automatic bill payment. 1. Make your payments on time · 2. Set up autopay or calendar reminders · 3. Don't open too many accounts at once · 4. Get credit for paying monthly utility and. The fastest way to get a credit score boost is to lower the amount of revolving debt (which is generally credit cards) you're carrying. The percentage of credit. The way to get a better credit score is to 1) consistently not have a ton of debt, 2) pay down the debt you have at regular and consistent intervals, and 3). How do you improve your credit score? · Review your credit reports. · Pay on time. · Keep your credit utilization rate low. · Limit applying for new accounts. · Keep. You can optimize this by adjusting both variables; you can spend less, and you can open new credit accounts or ask for increases on your existing credit limits. How to Build Good Credit · Review your credit reports. · Get a handle on bill payments. · Use 30% or less of your available credit. · Limit requests for new credit. Building a good credit score · Create a plan · Contact all creditors. · Pay off delinquent accounts first, then debts with higher interest rates; you may save. One of the easiest ways to improve your credit score is by paying your bills on time every month. This will start to eliminate your credit card debt. Your. If your creditworthiness has taken a ding, these fixes should spruce it up · 1. Check your credit report at least once a year · 2. Set up automatic bill payment. 1. Make your payments on time · 2. Set up autopay or calendar reminders · 3. Don't open too many accounts at once · 4. Get credit for paying monthly utility and. The fastest way to get a credit score boost is to lower the amount of revolving debt (which is generally credit cards) you're carrying. The percentage of credit. The way to get a better credit score is to 1) consistently not have a ton of debt, 2) pay down the debt you have at regular and consistent intervals, and 3).

Simple ways to raise your credit score · Check for errors on your credit report · Experian Dark Web Scan + Credit Monitoring · Refinance your credit card debt. Need to boost your credit score? These 4 programs can help (for free) · 1. Experian Boost · 2. TurboTenant Rent Reporting · 3. UltraFICO · 4. Grow Credit. Keep your credit card balances as low as you can. Ideally, you should pay your credit cards off in full each month. If that's not possible, do the best you can. FICO says paying down your overall debt is one of the most effective ways to boost your score. Don't close paid-off accounts. Closing unused credit card. Pay your bills on time · Keep your balances low · Don't close old accounts · Have a mix of loans · Think before taking on new credit · What to read next. Keep unused accounts open. The length of your credit history accounts for 15% of your score, so closing old accounts may negatively affect your score. Open. Pay down credit card debt If high credit card debt is weighing on your score, paying off all or most of it in one swoop could give your score a quick and. Review your credit reports for errors and dispute any inaccuracies. · Keep paying your bills on time. · Improve your credit mix. · Improve credit utilization. You can optimize this by adjusting both variables; you can spend less, and you can open new credit accounts or ask for increases on your existing credit limits. Dispute any errors that you find. This is the closest you can get to a quick credit fix. A Consumer Reports study found that 34% of consumers have at least one. Reduce the amount of debt you owe · Keep balances low on credit cards and other revolving credit: high outstanding debt can negatively affect a credit score. 8 ways to help improve your credit score · 1. Never miss a bill due date · 2. Keep your balances low · 3. Think twice before closing old cards · 4. Be cautious. Beware of credit-repair scams. Sometimes doing it yourself is the best way to repair your credit. The Federal Trade. Commission's “Credit. Repair: How to Help. One good step is to start a debt reduction plan to clear up your finances—and set you on the path to a better score. Start by paying off your high interest rate. Establishing good credit habits is essential so that you can build and improve your credit history and credit score. How to improve your credit scores · 1. Review credit regularly · 2. Keep credit utilization ratio below 30% · 3. Pay your bills on time · 4. Make payments on past-. FICO says paying down your overall debt is one of the most effective ways to boost your score. Don't close paid-off accounts. Closing unused credit card. You are allowed to use a primary cardmember's credit card and, if payments are made on time and in full, this can help build your score. That's because payment. Three ways to raise a credit score quickly are to pay off outstanding debts, ask for an increased credit limit and become an authorized user on someone else's. 1. Lower Your Credit Utilization Ratio. Each line of credit you have has a maximum amount. The percentage of that that you've charged is your credit.

Best Online Stock Trading Company For Beginners

Fidelity is a great choice. They have everything from basic to comprehensive investing help and capabilities available. Leading online trading solutions for traders, investors and advisors, with direct global access to stocks, options, futures, currencies, bonds and funds. Schwab, Fidelity, and Vanguard are all well respected in this community. Other alternatives exist as well and may be just a good. E*TRADE from Morgan Stanley charges $0 commission for online US-listed stock, ETF, mutual fund, and options trades. Exclusions may apply and E*TRADE from. Moomoo. moomoo by FUTU is a great brokerage for investors who are looking for a platform that allows them to get the most bang for their buck. · Tiger Brokers. Zerodha is the number 1 broker for beginners with Rs 20 maximum brokerage and no cost delivery trading. Also, it has designed a beginner-friendly Kite platform. 11 best trading platforms for beginners. Best overall: SoFi Invest; Robinhood; Public; Stash; Opto; Interactive Brokers; M1 Finance; Webull; Moomoo; Cash App. Firstrade Securities offers investment products and tools to help you take control of your financial future. Experience commission-free trading with us. fxtm is a great online trading platform for beginners. It has low trading fees, advanced tools, and resources to help new traders learn the. Fidelity is a great choice. They have everything from basic to comprehensive investing help and capabilities available. Leading online trading solutions for traders, investors and advisors, with direct global access to stocks, options, futures, currencies, bonds and funds. Schwab, Fidelity, and Vanguard are all well respected in this community. Other alternatives exist as well and may be just a good. E*TRADE from Morgan Stanley charges $0 commission for online US-listed stock, ETF, mutual fund, and options trades. Exclusions may apply and E*TRADE from. Moomoo. moomoo by FUTU is a great brokerage for investors who are looking for a platform that allows them to get the most bang for their buck. · Tiger Brokers. Zerodha is the number 1 broker for beginners with Rs 20 maximum brokerage and no cost delivery trading. Also, it has designed a beginner-friendly Kite platform. 11 best trading platforms for beginners. Best overall: SoFi Invest; Robinhood; Public; Stash; Opto; Interactive Brokers; M1 Finance; Webull; Moomoo; Cash App. Firstrade Securities offers investment products and tools to help you take control of your financial future. Experience commission-free trading with us. fxtm is a great online trading platform for beginners. It has low trading fees, advanced tools, and resources to help new traders learn the.

Robinhood has commission-free investing, and tools to help shape your financial future. Sign up and get your first stock free. Limitations and fees may. Buy, sell, and trade stocks online with a brokerage account from Wells Fargo Advisors WellsTrade. Fidelity - the best broker for free stock trading in Commission-free US stocks and ETFs. Great trading platforms and research. US and international stocks. Best Online Brokers Offering Commission-Free Trades · Best Overall: Charles Schwab · Best for Sophisticated Traders: TradeStation · Best for Beginners: Robinhood. Charles Schwab is our best overall online broker for beginners because of its massive library of evergreen educational materials, unmatched live coaching and. Meanwhile, CGS-CIMB-backed ProsperUs is also one of the best overall brokers out there. Aside from stocks, ProsperUs also offers ETFs, mutual funds, bonds, CFD. Powerful trading platforms, valuable stock market research, trading ideas, exceptional customer service. Open an account now. Interactive Brokers · Fidelity · TD Ameritrade · Charles Schwab · Merrill Edge · E-Trade · TradeStation · Firstrade · Ally Invest · Vanguard. Can I buy. If you are looking for the best brokerage for beginner investors, we have a tie between Charles Schwab and Fidelity. Not only are they two of the largest, full-. In summary, here are 10 of our most popular stock trading courses · Practical Guide to Trading: Interactive Brokers · Financial Markets: Yale University · Trading. Top 5 Best Online Stock Brokers · Best for Active Traders: LightSpeed Trading · Best for Cheapest Commissions: ThinkorSwim via Charles Schwab · Best for. E*TRADE E*TRADE is a financial services company that is part of Morgan Stanley. It offers $0 commission trades and an advanced trading platform that makes it. What makes it great: SoFi Invest is an excellent online brokerage account option for newly active stock traders. Any digital native, from Gen X to Gen Z, will. Kiplingers3 rated Fidelity Best Online Broker in For , NerdWallet4 rated Fidelity the Best App for Investing and the Best Online Broker for Beginning. Zacks Trade is a broker that should appeal to active traders with its advanced trading platform and ample research offering. New investors may be turned off by. Since E*Trade has been around for a while, both advanced and beginner investors can use this platform for their interests. You can use desktop and mobile tools. The first step in purchasing shares is to have a brokerage firm as the broker will help you execute your trades. You can choose from the local brokerage firms. Interactive Brokers is an online brokerage platform that offers a unified platform for trading stocks, options, futures, currencies, bonds, and funds. They. Although it's a fee, you'll pay this with all brokers, and eToro and Trading are the cheapest out there. So, the best low cost, online stock broker is eToro. DEGIRO is Europe's fastest growing online stock broker. DEGIRO distinguishes itself from its competitors by offering extremely low trading commissions.

How To Buy Land And Build A House On It

Work with Real Estate Agents · Show you land which may not be included in local listings · Verify the land's history and applicable building codes or restrictions. Your land equity will cover the down payment requirement (% minimum for FHA loans). You might need to purchase the lot; in which case it is important to. Rural 1st's guide to buying land and building a house provides many details, from finding the right land to choosing the right contractor. Read more here. Step 1: Pre-Construction · Contract · Soil test from property (determines proper foundation) · Boundary survey (determines size and boundaries of the lot) · Site. We'll cover everything you need to know about buying land. Here's what the experts have to say about where to find land, how much land costs, and ways to pay. WHAT LICENSES AND PERMITS DO YOU NEED TO BUILD A HOUSE ON YOUR OWN LAND? This completely depends on how you choose to build your home. But regardless, you could. “If someone is buying land and building a house, they are able to do a construction home loan to purchase the land and build their house,” says Taylor. Richr wants to help dreamers realize the steps for buying land to build a house in Florida to see if it's the solution they've been waiting for. Step 1: Set a foundation for your search. Step 2: Find land to build your home. Step 3: Ensure that the land is buildable by conducting due diligence. Work with Real Estate Agents · Show you land which may not be included in local listings · Verify the land's history and applicable building codes or restrictions. Your land equity will cover the down payment requirement (% minimum for FHA loans). You might need to purchase the lot; in which case it is important to. Rural 1st's guide to buying land and building a house provides many details, from finding the right land to choosing the right contractor. Read more here. Step 1: Pre-Construction · Contract · Soil test from property (determines proper foundation) · Boundary survey (determines size and boundaries of the lot) · Site. We'll cover everything you need to know about buying land. Here's what the experts have to say about where to find land, how much land costs, and ways to pay. WHAT LICENSES AND PERMITS DO YOU NEED TO BUILD A HOUSE ON YOUR OWN LAND? This completely depends on how you choose to build your home. But regardless, you could. “If someone is buying land and building a house, they are able to do a construction home loan to purchase the land and build their house,” says Taylor. Richr wants to help dreamers realize the steps for buying land to build a house in Florida to see if it's the solution they've been waiting for. Step 1: Set a foundation for your search. Step 2: Find land to build your home. Step 3: Ensure that the land is buildable by conducting due diligence.

Find the cheapest way to buy land and build a house. Follow these steps to save house buiding costs and make an informed decision. Building a custom home is a dream for many, but the journey begins long before laying the first brick. ; The adage "location, location, location" rings. Buy Open Buy sub-menu. Los Angeles homes for sale. Homes for sale · Foreclosures · For sale by owner · Open houses · New construction · Coming soon · Recent. Buy the property. Hire an architect or qualified home designer to design the house and required site work. Then shop the permit ready plans with. Figure out what you want in your land such as proximity to cities/services, climate, etc., then find a realtor in regions that meet your needs. Rural 1st's guide to buying land and building a house provides many details, from finding the right land to choosing the right contractor. Read more here. Some buyers purchase land to build on, others customize pre-built homes, and many also buy land that's likely to accumulate value. But how does that work. You will definitely want to take these three considerations into account before you purchase land in the Charlotte area for your new home. Before you buy any land to build on, pay a visit to the county planning & zoning office to ask about any zoning laws that might not allow you to build there. Financing a property on which to build your dream home is much more complex than applying for a mortgage. Lenders require surveyed boundaries, and you'll need. Here we detail what every land owner should know - everything from zoning, environmental, and water drainage to other factors unique to this type of purchase. Here we detail what every land owner should know - everything from zoning, environmental, and water drainage to other factors unique to this type of purchase. Make sure the prospective land has access to a street. If it doesn't, you will need to get an easement, or permission to use a neighbor's property, to access. Here we detail what every land owner should know - everything from zoning, environmental, and water drainage to other factors unique to this type of purchase. Another important factor to consider when buying land to build a home is the size of the property. The size of the land plays a crucial role in determining the. Find out if the land is in a flood plain. Make sure it has proper drainage. The type of soil on the property matters when building a home, so it's a good idea. This blog post also considers the top mistakes to avoid making when you build your own home in Maine. First the Maine land. Residential Home Loan. Look for local lenders. This time you're looking for a house and land “package” loan. With this type of loan the price of the land will. Let's take a look at four helpful tips you can use to simplify the process of buying a lot and building a house. Looking to Buy Land and Build a House? · Choosing the Perfect Location · Setting Your Budget · Financing Your Land Purchase · Finding and Evaluating Land for Sale.

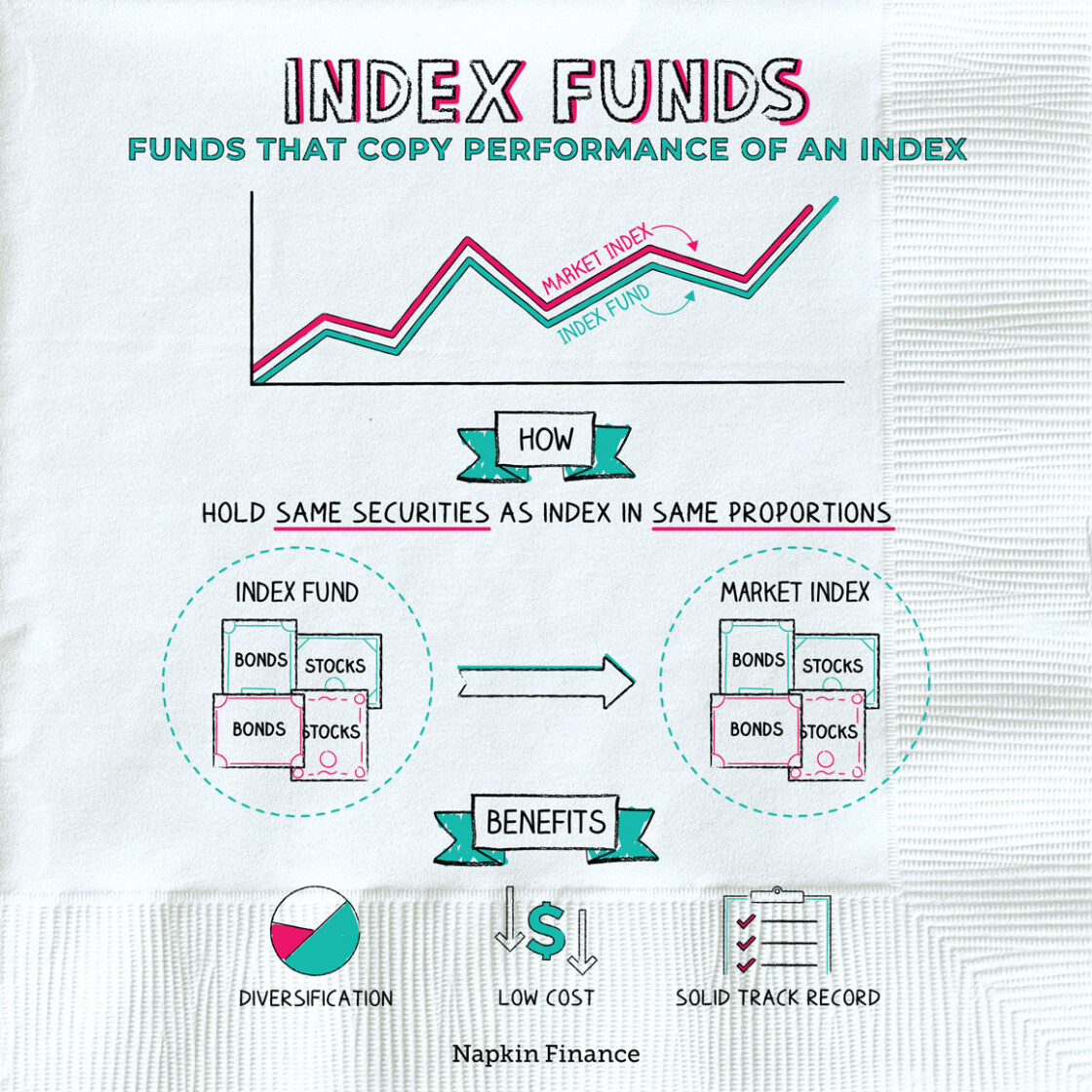

How To Invest Index Funds

That's why you may hear people refer to indexing as a "passive" investment strategy. Instead of hand-selecting which stocks or bonds the fund will hold, the. Welcome to Canadian Couch Potato, a blog designed for Canadians who want to learn more about investing using index mutual funds and exchange-traded funds. How To Invest in Index Funds · Choose your investment platform: Begin by selecting an online brokerage or investment platform. · Open and fund an account: Once. In terms of performance, index funds aim to match benchmark returns while actively managed funds. In terms of management fee, that of index funds is lower. Here's everything you need to know about index funds and ten of the top index funds to consider adding to your portfolio this year. If you're looking for a passive investment strategy with low fees, index funds can be a good option. They're designed to track and perform like market indices. When you put money in an index fund, that cash is then used to invest in all the companies that make up the particular index, which gives you a more diverse. If a fund or ETF doesn't offer the potential to outperform an index or benchmark, cost becomes more important when selecting investment options. When evaluating. An index fund is a type of mutual fund or exchange-traded fund (ETF) that holds all (or a representative sample) of the securities in a specific index. That's why you may hear people refer to indexing as a "passive" investment strategy. Instead of hand-selecting which stocks or bonds the fund will hold, the. Welcome to Canadian Couch Potato, a blog designed for Canadians who want to learn more about investing using index mutual funds and exchange-traded funds. How To Invest in Index Funds · Choose your investment platform: Begin by selecting an online brokerage or investment platform. · Open and fund an account: Once. In terms of performance, index funds aim to match benchmark returns while actively managed funds. In terms of management fee, that of index funds is lower. Here's everything you need to know about index funds and ten of the top index funds to consider adding to your portfolio this year. If you're looking for a passive investment strategy with low fees, index funds can be a good option. They're designed to track and perform like market indices. When you put money in an index fund, that cash is then used to invest in all the companies that make up the particular index, which gives you a more diverse. If a fund or ETF doesn't offer the potential to outperform an index or benchmark, cost becomes more important when selecting investment options. When evaluating. An index fund is a type of mutual fund or exchange-traded fund (ETF) that holds all (or a representative sample) of the securities in a specific index.

1Efficient access– There's an index, and an index fund, for almost every market exposure and investment strategy you can possibly need. More choice gives. An index fund (also index tracker) is a mutual fund or exchange-traded fund (ETF) designed to follow certain preset rules so that it can replicate the. When an investor invests in an index fund, he buys a blend of investments that mimics the makeup of a market index. The investors can buy all these assets in. Index funds are a special type of mutual fund. A mutual fund is a financial vehicle that pools money from investors and invests it in securities such as stocks. Index funds don't change their stock or bond holdings as often as actively managed funds. This often results in fewer taxable capital gains distributions from. How To Invest in Index Funds · Choose your investment platform: Begin by selecting an online brokerage or investment platform. · Open and fund an account: Once. Passively managed Exchange-traded funds (ETFs) seek to replicate the performance of the index they track. · ETFs can fit well with other types of investments in. Yes, index funds are available in Canada and are a popular investment choice for many Canadian investors. These funds are designed to mirror the performance of. An index fund is a type of mutual fund that aims to track the performance of a stated financial market index by building a portfolio that invests in all or. You can purchase index funds through a brokerage firm or the fund provider's website. Most people opt for the former since this will give you more investment. An “index fund” is a type of mutual fund or exchange-traded fund that seeks to track the returns of a market index. Open a brokerage account with a financial firm and purchase an index fund. It should tell you the cost ratio (fees), which they take out of the. An index fund will attempt to achieve its investment objective primarily by investing in the securities (stocks or bonds) of companies that are included in a. Schwab Equity Index Funds are among the lowest-cost index funds around. Fund operating expenses are below the industry average, and there are no loads or. Now, indexed ETFs have further expanded the popularity and flexibility of index investing. Vanguard, the world's largest index fund company, now has over $5. Index funds are simple, low-cost ways to gain exposure to markets. They're most commonly available as mutual funds and exchange traded funds (ETFs). Index funds aim to replicate the performance of a particular market index. While some invest in all securities within the index, others opt for a sample. Market. Over the long term regular saving each month will provide good time diversification. You can start saving monthly in index funds through Nordea Mobile or. Many new investors start out investing with mutual funds and exchange-traded funds (ETFs) since they require smaller investment amounts to create a diversified. Now, indexed ETFs have further expanded the popularity and flexibility of index investing. Vanguard, the world's largest index fund company, now has over $5.